In accounting, assets are what a company owns, while liabilities are what a company owes. Liabilities are usually found on the right side of the balance sheet; assets are found on the left. Tangible assets are physical objects that can be touched, like vehicles and equipment. Intangible assets are resources without physical presence, though they still have financial value. A business with substantial current assets has the working capital to cover operational costs and pay its debts without borrowing money. Assets, liabilities and owners’ equity are the three components that make up a company’s balance sheet.

A brief review of Apple’s assets shows that their cash on hand decreased, yet their non-current assets increased. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Balance sheets can be used with other important financial statements to conduct fundamental analysis or calculate financial ratios. Like businesses, an individual’s or household’s net worth is taken by balancing assets against liabilities. For most households, liabilities will include taxes due, bills that must be paid, rent or mortgage payments, loan interest and principal due, and so on. If you are pre-paid for performing work or a service, the work owed may also be construed as a liability.

Non-Current (Long-Term) Liabilities

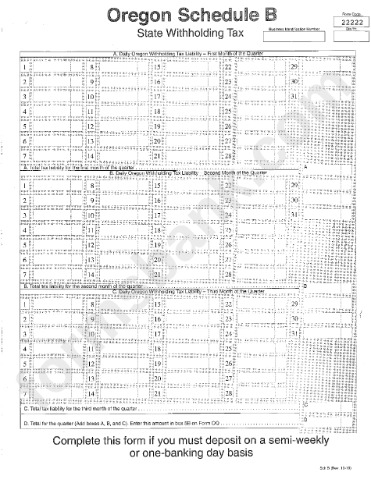

The primary classification of liabilities is according to their due date. The classification is critical to the company’s management of its financial obligations. In addition, liabilities impact the company’s liquidity and, in the case of debt, capital structure. The image below is an example of a comparative balance sheet of Apple, Inc. This balance sheet compares the financial position of the company as of September 2020 to the financial position of the company from the year prior. Different accounting systems and ways of dealing with depreciation and inventories will also change the figures posted to a balance sheet.

Some companies will class out their PP&E by the different types of assets, such as Land, Building, and various types of Equipment. This account includes the balance of all sales revenue still on credit, net of any allowances for doubtful accounts (which generates a bad debt expense). As companies recover accounts receivables, this account decreases, and cash increases by the same amount.

Importance of Asset Classification

However, it should disclose this item in a footnote on the financial statements. Shareholder equity is not directly related to a company’s market capitalization. The latter is based on the current price of a stock, while paid-in capital is the sum of the equity that has been purchased at any price. A liability is something a person or company owes, usually a sum of money. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. The expense account is the last category in the chart of accounts.

Oftentimes, these may also include investments into the business by the business owners or other investors through the purchase of shares. They help a business manufacture goods or provide services, now and in the future. A company needs to have more assets than liabilities to have enough cash (or items that can be easily converted into cash) to pay its debts.

Why Does Current versus Noncurrent Matter?

Still, liabilities aren’t necessarily bad, as they can help finance growth. For example, a line of credit is taken out to purchase new tools for a small business. These tools will help the company generate revenue, which is a good thing. The trick is to make sure liabilities don’t grow faster than assets.

Companies will segregate their liabilities by their time horizon for when they are due. Current liabilities are due within a year and are often paid for using current assets. Non-current liabilities are due in more than one year and most often include debt repayments and deferred payments.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Monies owed to the company which contains interest payments in addition to the main balance are notes receivable. Accounts receivable is an asset account that comprises money owed to the company by its clients. Prepaid expenses are payments made in advance for products or services such as insurance, electricity, cable tv, and internet.

- Some of the components of the owner’s equity accounts include common stock, preferred stock, and retained earnings.

- Take a deep dive in studying with our full guideline on principles of accounting.

- Likewise, it is helpful to know the company owes $750,000 worth of liabilities, but knowing that $125,000 of those liabilities will be paid within one year is even more valuable.

- Noncurrent assets are long-term assets that can’t be liquidated within the current fiscal period.

The term balance sheet refers to a financial statement that reports a company’s assets, liabilities, and shareholder equity at a specific point in time. Balance sheets provide the basis for computing rates of return for investors and evaluating a company’s capital structure. Liability accounts provide a list of categories for all the debts that the business owes its creditors. Typically, liability accounts will include the word “payable” in their name and may include accounts payable, invoices payable, salaries payable, interest payable, etc. Some items can be classified in both categories, such as a loan that’s to be paid back over 2 years. The money owed for the first year is listed under current liabilities, and the rest of the balance owing becomes a long-term liability.

How Do You Find Net Assets From Liabilities?

She’s passionate about helping people make sense of complicated tax and accounting topics. Her work has appeared in Business Insider, Forbes, and The New York Times, and on LendingTree, gross profit vs operating income chron.com Credit Karma, and Discover, among others. We expect to offer our courses in additional languages in the future but, at this time, HBS Online can only be provided in English.

Malaysian Pacific Industries Berhad (KLSE:MPI) Has A Pretty Healthy Balance Sheet – Simply Wall St

Malaysian Pacific Industries Berhad (KLSE:MPI) Has A Pretty Healthy Balance Sheet.

Posted: Sun, 03 Sep 2023 00:35:10 GMT [source]

You’d need to ensure you have $1,000 ready to pay the supplier so production doesn’t stop. Depending on the type of liability, you may have to pay it back immediately or at some point in the future. Liabilities are divided into two categories based on when they’re due—short-term liabilities and long-term liabilities. Fixed assets, also known as non-current assets or long-term assets, help you run your business in the long term. For example, your equipment enables you to get work done faster, and your office space helps impress new clients.

What Are Assets and Liabilities?

With smaller companies, other line items like accounts payable (AP) and various future liabilities like payroll, taxes will be higher current debt obligations. Knowing your business inside out determines your success as a business owner. Most business owners have a basic understanding of how much their business owns and what it owes other people. In other words, they are aware of their basic assets (like their bank balance, inventory, and equipment) and liabilities (like account payables, loans, and debts). Assets are what a business owns, and liabilities are what a business owes.

Non-current or long-term liabilities generally require over a fiscal year for repayment. Common examples of long-term liabilities include capital leases, bonds payable, pension payments, debentures, mortgages, and deferred taxes. Contingent liabilities are liabilities that may result based on the outcome of a future event such as the outcome of a lawsuit, injuries from product use, or honoring product warranties. Common examples of contingent liabilities include non-operating, legal, product, and warranty liabilities.